Kikoff - Build Credit Quickly

June 01, 2024More About Kikoff - Build Credit Quickly

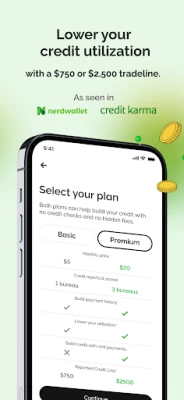

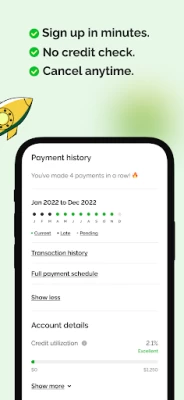

Sign up for Kikoff Basic plan for just $5/month or Premium plan for $20/month. You’ll get a credit line reported to Equifax, Experian, and TransUnion** every month. Each on-time payment builds payment history, which helps your credit! Whether you have a low credit or no credit, we make it easy and worry-free – no credit check required and it only takes a few minutes to apply.

How it works:

1. We lower your credit utilization with a $750 or a $2,500 tradeline.

2. You make a purchase with that tradeline (limited to Kikoff), and you just pay back what you spend (our lowest + most popular payment amount is $5/month). We report those payments to Equifax, Experian, and TransUnion every month while your utilization rate stays low.

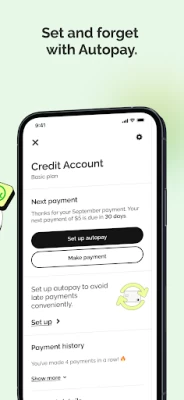

3. You have the option to put your credit building on autopilot by turning on AutoPay – that’s right, no heavy lifting required from you after account setup.

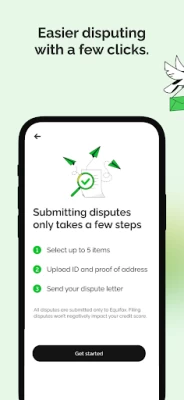

4. We flag errors on your report. Also, users with Premium Credit Service account can sign up to Rent Reporting to have their rent payments reported.

Kikoff helps you build credit by establishing a payment history and maintaining a low utilization rate, all with no unexpected fees or interest.

*Credit Score Increase: Based on Kikoff customers who start with 600 or below credit. Payment behavior can have an impact on your credit score, and individual results may vary. Data current as of March 2022.

**Which bureaus are reported to depends upon which Kikoff products you have. Kikoff Credit Account and Secured Credit Card reports to Equifax, Experian, and TransUnion.

Latest Version

1.73.915

June 01, 2024

Kikoff, Inc.

Finance

Android

2,031,674

Free

com.kikoff

Report a Problem

User Reviews

Amber Nadeau

3 years ago

This app is awesome! In 7 months my credit score has gone up 76 points!! Simple, easy, and effective! Purchase a credit package for $24 with a $500 credit limit. Make 12 monthly payments of $2/month. Autopay or not, up to you. Reports to 2 of 3 credit bureaus. Classified as a credit account. Now offering their "loan" product...you pay $10/month into an account for 12 months. At the end of the "loan" you get your money back plus interest. Reports on credit report as a loan to diversify your score

LISA LOVEDAY

4 years ago

so far the app is pretty legit it has helped my credit quite a bit I've only been making my payment (which it's only $2 a month) for 3 months now and my credit score is already risen by 60 points. the only negative is, for some reason, after making two auto payments from my primary bank account (which has the funds available) the card all of a sudden declined and I had to switch payment options. I would definitely recommend this app to anyone trying to raise their credit.

Mikeal Segotta

4 years ago

I've only just begun to use this app/service, but it seems like a great way to improve your FICO score. By issuing a $500 line of credit of which you only use $20, it give you a 4% utilization of the credit. Lots of eBooks and video courses to choose from and setting up auto payments gor the $2 per month payments I'm surely going to make all 10 on time. Free access to your current FICO score and alerts for items that need to be taken care of. The app itself is a bit slow.

Michelle Burton

4 years ago

EVERY TIME I open the app, my phone freezes, fritzes out, and winds up restarting itself. Last week oflr the week before, I could open it 5x daily with no issues. The first time it did this over the weekend, I went through and updated my phone AND made sure the app was up to date. Obviously that wasn't the issue. I can open ANYTHING else on my phone and I don't have any issues.

Annette Crouse

1 year ago

Horrible app and program. I was excited at first until it came time to pay for my monthly plan. Well I signed up for the lower plan to start but accidently hit the higher dollar plan. I contacted customer service and told them about the issue, they responded and told me it was fixed. I went back in still the same. Looked at my cash app and they are still trying to take the higher subscription amount out of my cash app. So I contacted customer service again they said its fixed, no it's not.

Terrence Glasgow

1 year ago

A horrible waste of time. I have been enrolled in this program since September and my credit score has increased only 5 points. Every month I have made my payment on time since they pull it at the most inopportune times. My next payment will be to close out the account. Reconsider using this app. It is a waste of time and money. And with the response I got below says it all. Thanks again! A year later 1/5/2024 and now it shows as a delinquent account on my credit. Thanks Kickoff for nothing!

Catherine Bemount

1 year ago

huge catch that isn't properly explained. while it gives you a $750 credit line, you actually never have access to it. they charge you $5 a month on a "bill" of $60 to show good payment history and that credit line only shows on your credit report. So if you want to build credit this is ok, BUT if you really needed the money don't waste your time.

Marqueta Echols

1 year ago

DONT. You will get a small boost. However, you will get a larger decline if you cancel your subscription. It shows as a closed account. You pay them to post a "credit". You wont have access to this credit. It never shows a change in balance, even though you are paying a monthly fee. I know how important it is to build your credit. Don't let that desperate state make you do something that is not helpful like it did. You are better off getting a refundable deposit credit card.

Rodney Higginson

1 year ago

I found out about this company early on, when you would borrow $12 and pay back a $1 a month. Then they grew and had other products, cool. The thing I dislike was their customer service or lack of one. It was hard to reach someone. And then when I sent my payment of $11 (bill was $10 and change), I was sent the entire payment back with a note stating I need to send the exact amount, I'm done. Obviously, I didn't care about the leftover change.

M Faal

1 year ago

App lowered my credit score. Had the account for several months, ended up changing quite a few things in life, job, apartment, etc. Didn't really have a need for the service and coming back to it now see that instead of the subscription for credit builder simply lapsing, it instead reported months and months of missed payments to my credit lol. Well played sir.

Chris Tina

1 year ago

I thought that we would get a portion of the money that we put in back. We don't. You essentially pay them $20/month, and you never see it again. If you are seeing significant results as far as your credit goes, it might be worth it, but if you aren't the you're just stuck giving your money away. You get trapped just paying the remainder off - you can't close the account because it wil negativelyl affect your credit. Also, the app keeps logging me completely out.

Kevin Meier

1 year ago

Kikoff does what they say, and it definitely helped me bump my score up a little. Unfortunately the app is abysmal, constantly logging you out, and may the gods help you if you need to change your address. I have moved twice and haven't been able to change my address at all-- so the address they have is 2 rentals ago! The "verify identity" button does nothing, and their chat support was not able to do anything.

B C

1 year ago

It was cool at first. Then they turned into a snakey joke. If you upgrade to the $20 a month deal they have. They pretty much just rip you off and give you a credit you can't access or get your money back. And it just links it to an online store full of junk no one wants. If you cancel any credit you built gets taken back and they sink your score back to what it was before you started. I feel scammed, ripped off, and extremely unhappy with this company

William P.

1 year ago

This thing is a total joke. I was sick for 2 months. I haven't been laid on any payments and four and a half years on eight trade lines. A car payment anything 100% perfect payment history. I was sick. Couldn't make payments on anything for 2 months. I was getting overdraft fees from the stupid kickoff and I couldn't cancel it. It'll hit my credit even harder. I finally did. Now it's showing them 90 days past due. 668score to 480 to 530 lost 30 pts because kickoff !!!! H8u

Alex Westendorff

1 year ago

Great app but more issues recently. Biggest issue is, me and my wife both have this, we finished our savings out, over a week ago, and still have never been able to draw the money back out. This normally happens as soon as the last payment is paid. Not anymore, day after day I check to no avail. No chat customer service, have to call and I don't have time for that. Not happy and wish you would release our funds.

Cassandra B

1 year ago

love kikoff, it helped me gain credit in a quick pinch by boosting my score 120 pts just in time to buy a house! the timing couldn't have been better, and we've been in our new home for over a year now! I love the ease of use, and the auto payment feature is perfect for setting it and forgetting it with payments. starting off with a small payment, $5!, allowed for super flexibility in gaining credit when I had literally wiped mine clean (14 years gone) paying off my last debts holding me back.

Cher Tesmar

1 year ago

I love this app and recommend to anyone who wants to get their credit score up and quickly and so easy. I had horrible bad credit and was able to start fixing it almost the very next day. it doesn't cost hardly anything. check out how it works and you will see what I mean...and no thanks needed but you are welcome. spread kindness. there is enough for everyone

James “Jimmy James” OHara III

1 year ago

amazing, it's not for you to use as a credit card even though you can put money on there. it's mainly used as a credit builder I've been using it since July of 2023 & I have up my credit a lot. so if that's something you're interested in and I recommend you getting this app. five stars so far and you get all 3 credit bureaus for free. and honestly you can choose your own fees as low as I think $5 or $10 a month I have the $20 plan. just because it's easier and faster good luck. TYVM. Jimmy James

W & P

1 year ago

Weird bug when trying to link my Capital One account, never had an issue with plaid before but every time at the last step when I go to hit Authorize, it gives error "page not available". Have to reopen the app to get rid of it & still doesn't show as linked.. tried 3x now. And why doesn't Kikoff allow me to pay future months in advance? I was willing to pay for 6+ months of Ultimate & the additional $10/mo credit program on the spot, but I guess it can't be that convenient..?

Anastasia Sanchez

1 year ago

I don't recommend. First month or so it helped my credit. Hasn't done much for me since then. Finding out I was only paying a subscription to help with my credit, not for a credit line which I was under the impression I would be getting back. Could never figure out the "store" which is the only place you can use your "credit". The app seems basic but doesnt actually help with anything. Find another credit line where you actually have access to the money you're paying and still helps with credit.