Atlas - Rewards Credit Card

June 10, 2024More About Atlas - Rewards Credit Card

4x higher approval rates than traditional credit cards. Get approved instantly without leaving the app.

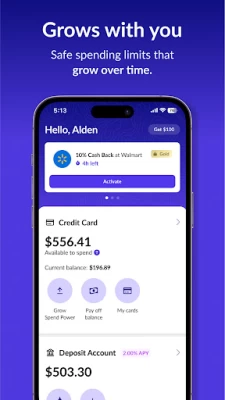

GROWS WITH YOU

Connect with 10,000+ banks to determine a safe spending limit you can easily repay without building up a balance. 0% APR ensures you never pay interest. Keep using the card to get higher limits.

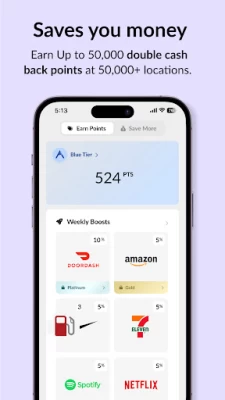

SAVES YOU MONEY

Automatically save up to 10% at 50,000+ locations of places you love. These include Starbucks, Nike, DoorDash, Shake Shack, Burger King and more. We are always adding national and local savings.

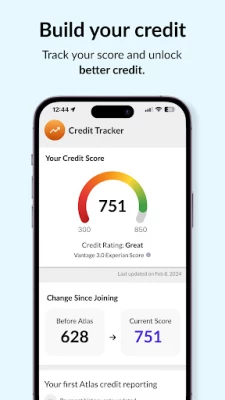

BUILDS YOUR CREDIT

You will start building credit with daily transactions. Built in auto-pay ensures that you never have to worry about missing a payment. Track your score in the app and watch it progress on auto-pilot.

Atlas reports to all 3 major credit bureaus - Equifax, Experian and Transunion.

SAFE AND SECURE

Shut down shady transactions by blocking your card anytime. You also get complete fraud protection that only credit cards offer. Atlas is built with industry leading security best practices in partnership with Patriot Bank and Mastercard.

NO HIDDEN FEES

Simple pricing: only $8.99/month

No other hidden, or surprise fees

—

Atlas is not a bank. The Atlas card is issued by Patriot Bank pursuant to a license from Mastercard®. Atlas may be used everywhere Mastercard® credit cards are accepted.

Rewards and credit services are offered and managed by Atlas. Increase in credit score is dependent on on-time payment behavior and never guaranteed. Credit scores are impacted by many factors and an Atlas card is one of them.

Latest Version

2.9.23

June 10, 2024

Exto Inc.

Finance

Android

265,261

Free

com.exto.arrow

Report a Problem

User Reviews

Brent Twomey

1 year ago

I saw this on Facebook and decided to try it. Application was easy and quick approval. Went to download the app and finish setting up my account as instructed and it doesn't seem to work. Everytime I try to access the app it brings up a screen that says it needs a moment to verify account information but it never does anything just keeps loading. I have waited as long as 20 minutes to no avail.

Russell Orem

1 year ago

Make sure to watch the Support videos! It's more useful than you think. When I first signed up for this, it sounded like you deposit $20 to your account, it increases your credit $20. So if i spent that $20 i have to repay my own $20? Its not that at all. You have a debit account, and a credit account. The more you deposit and keep in the cash account, your credit keeps increasing, which actually helps your credit score quite a lot. This is actually quite useful

Christie Twyman

1 year ago

Excited to try this app the features are nice. It's a little disappointing to have to verify over and over. My account was fully verified, and wake up to a email stating I have to verify again. I have business bank accounts that don't even do that. I'm a little hesitant on starting, also think it's a little silly to have to pay the monthly fee right off the back to start up. I would like to see how it works. Also when it says you have $$ available to spend, and it's not actually there, 😑

Carrie Phillipson

1 year ago

I've been using Atlas for a couple months now, and have upgraded to the annual plan. The ease of access and user friendly app is a star in itself, and the actual services give it the 5/5. Transferring, withdrawing, making payments, and utilization are so easy to use. Highly recommend. The only thing I've taken a problem with, is I had just paid my monthly membership fee, then upgraded to the annual and was charged for that, but didn't get my monthly fee back afterwards, so I paid extra.

Angela Benton

1 year ago

It costs too much a month. It has a fluctuating spending limit. The one time I actually went to use my card, it went from a limit of $50 down to $5 or $10 I can't exactly remember. Now I'm trying to close out my account and I keep getting bot options. I can't even type in my own words. I really don't want this card anymore.....it's a thorn in my financials!

Kelsey Dugan (Kelsey Dawn)

1 year ago

Atlas has a REALLY easy, quick, and easy-to-use and easy to understand sign-up/setup process! They are a great option to help you not only build credit, but for a credit line for yourself as well. And there are truly so many perks, I can't even begin to name them all! Good experience so far, however, I am a new customer, so I'll update this review if anything changes, comes up, etc. 😀

Aaron Kollsmith

1 year ago

App works good. It's not as much about you getting credit as it is them getting a subscription. Sure I was approved, for a $10 line of credit JUST ENOUGH to cover the cost of their subscription. Forget about opting out. Your life altering line of credit isn't usable until AFTER you co firm and pay your sub in full. Credit line is supposed to Increase over time but by the looks of it youve likely paid for every dollar extended in advance. Your experiences will vary, this was mine.

John Harden

1 year ago

Very quick and efficient sign up process. Overall provides a ton of value in terms of features that you have available to you. Very inexpensive for what it offers you. Definitely will be referring my friends who are in need of starting their credit journey and don't know a great place to begin!!!

Jackie Ray

1 year ago

I just signed up but the process was quick and easy. Everything was explained and I really like all the features available to use. Videos of each aspect of the card are available and ordering my physical card was simple and quick. I am looking forward to building my credit and using everything available. It seems so far like a good thing.

Jesse Horton

1 year ago

By far the BEST credit building app that I have used &/or tried out. Very easy to use and even though their customer service team isn't the biggest, their extremely helpful, friendly and put the customer & his or her needs 1st no matter what. What could be better? While working on building your credit & enjoying the experience while doing so.. THANK YOU ATLAS && ALL OF THIER TEAM MEMBERS!!!

Nekquanna Cross

1 year ago

It's an ok credit building app. You do get approved, right away. This platform connects to your checking account to determine your credit worthy. This platform also offers you to add funds from your checking or debit card. Checking takes a few days. Debit card is quicker. But the debit card feature doesn't work. I have sent several emails. But nothing got done. Other than that, it's ok. One more thing I am not sure if it's reporting yet on my credit report. Hope this is helpful.

Benjamin Dougherty

1 year ago

So far it's been a very, very exciting start to a beneficial credit relationship. The fact that they are taking the time to add the extras like the phone warranty and the car rental extra added insurance. Those are the little things that I'm looking for and that just aren't provided anymore in these major credit companies, and the fact that they're doing it with extra rewards and these little bonuses that make it fun. Well, I can see a long relationship with these guys. Thank you, well done!

Miguel Rodriguez

1 year ago

Amazing app really helps you build credit, and the best part is if you have any issues costumer services is fast to respond and help you every time. Wanted to add, they have really impressed on how much they care about their customers, even when you're being unreasonable they continue to assist you in any issues you may have, my credit jumped up more than 30 points in the last month and it's still climbing. Thank you atlus for being an amazing team and great app to use!!!!!

Joel Peters

1 year ago

I really am starting to enjoy this a lot! You have options to set when you're charges will be taken out so you are aware of your money situation! Also I just joined, but am excited! There are many incentives and ways to increase your spending power and I've been looking for a way to boost my credit! The credit card must be like a secured credit card because you add money to it. I have dealt with customer service and although they don't have a call help center yet their email communication is gre

Ervin Batten

1 year ago

Atlas is a great way to rebuild credit. I love the app it has great features to help inform you own how to raise your score and many perks for cash back rewards and credit monitoring. No late fees. 0% interest. I highly recommend this for any one. You can't be denied because of past credit history. So this gives you a chance to start all over again. Thanks Atlas for a great product.

Alex Nelson

1 year ago

So consumer beware, this will not function as a true credit card, they require your account to be set up with "Smartpay", which automatically deducts your purchase from your bank account as soon as the day after purchase. Trying to buy something on credit because your rent is due and you're saving your cash for it? To bad, they'll take your rent money without shame. All in the name of building credit. I gave it 2 stars because as a credit builder it works, but as a credit card it falls flat.

Justin Maruska

1 year ago

What a great app for people who either do not have credit yet. Or, even people who need to build it back up. It's a very simple process. Quick amd easy to sign-up. They start you out at a very low amount. ($10) But if you put at least $50 or more of your employment direct deposit into your account here at atlas. That number will be much larger. Customer service is prompt and helpful. Love it.

Garry Gordon

1 year ago

Helpful only if it's your last option. While it DOES help build credit, it's a $25 limit and costs $10/mo that applies TO that limit. Also, if you spend money, it auto drafts your debit card (for a bigger fee, btw) every day. And you cant turn that off.. even if you direct deposit, it will still try and daily payoff the balance used on the card from your bank account.. a secure line credit card is WAY betrer for you, and easier on you, tbh.

La'Temperance Hall

1 year ago

Great way to build credit, split up payments so subscriptions are not taken out of your main account and you also get cash back with the weekly cash back bonuses. Only 3 stars because there is no way of canceling the SmartPay so it overdraft my account every time and wish they didn't lie about the $1,000 bonus for completing the task within a month. I got $10 very very disappointed, pretty much used as clickbait but the app is good though. But if they could fix those I would give it 5 stars.

Kandis Jonas

1 year ago

My original review was 4 stars but I've knocked it down to 2. I am so disappointed. I was really starting to loke this app. I was so excited. I set up direct deposit. Linked 2 of my bank accounts. I used the card and paid the balance immediately. I added the card to all of my subscriptions. And suddenly I went from $10 to $50 flex credit in 3 days! I was so stoked about this card! But suddenly right after they raised my limit I got an account restriction 😔