Bright - Crush Your Card Debt

June 11, 2024More About Bright - Crush Your Card Debt

Build Credit with simple secured Line of Credit starting $50(2)

Get personalized money management plans designed to repay debt.

All this with the AI-powered Bright App @ <$10/month(3)

What does the Bright App offer?

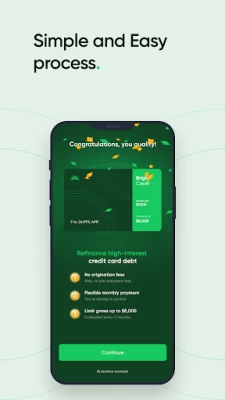

Pay down high-interest debt on a tap(1)

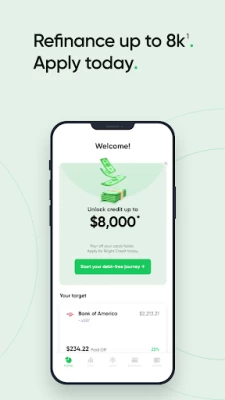

The Bright App can help you consolidate credit card balances, into a single Credit Line of up to $8,000(1). Pay it down with affordable monthly payments, and simplify your management.

Bright Credit Fees

Credit limit - $500 - $8,000

APR (Annual Percentage Rate - 9% –24.99%

Application fee - $0

Origination fees - $0

Late fees - $0

Prepayment fees - $0

Monthly minimum payment - 3%

(of the outstanding principal balance plus the accrued interest)

Example:

Credit limit - $5,000

APR (Annual Percentage Rate) - 12%

Outstanding Principal Balance - $5,000

Monthly minimum payment - $200

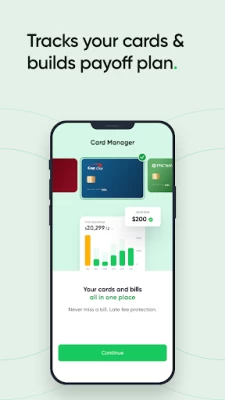

Manage all Credit Cards in one place

Simplify Credit Card management with the Bright App. Organize multiple cards and bills in one place and receive payment reminders. Avoid missed bills and debt with Bright’s AI-driven plan.

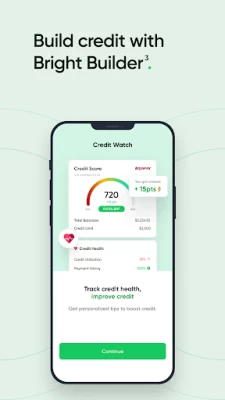

Build Credit with Bright’s Secured Credit Line.

Get a Secured Line of Credit starting at $50(2) on the Bright App. Make on-time payments(2)monthly, get your payments reported to the credit agencies, and build your credit.

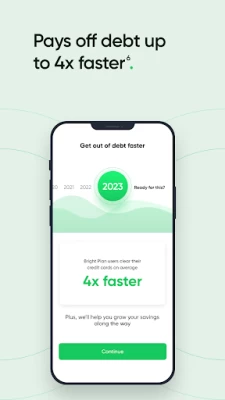

Build Savings that consistently grow

Bright’s AI-driven plan helps you pay down debt easily, creates a path to get debt under control, and builds your savings. Plan your financial future right.

AI-driven Budget Plan tailored for you:

The Bright App creates personalized payoff plans to repay debt easily. Whether you are planning a long-due trip, a favorite car, a new house, or a happy retirement, the Bright App guides you toward smart budgeting within your current income.

Expert tips to manage your money the smart way.

Get access to expert finance guidance on the Bright App. There are short articles, practical guides, and a comprehensive answer bank for all your money questions. A wealth of financial information to stay on top of your money.

Fast sign-up and 365 days Live chat support.

Signing up for the Bright App takes just 2 minutes(1). Get started with your personalized debt management and credit building. 24*7 Live Customer Chat Support.

For any queries at any point, email it to us on support@brightmoney.co or call us on +1 877-274-6494 [OPERATIONAL HOURS [Mon-Fri] - 9:30 TO 6:30 PM (CST)]

Join the community of 1 million+ satisfied customers who have experienced the benefits of the Bright App.

(1)Bright Credit is a line of credit that can be used to pay off your credit cards. Subject to credit approval. Variable APR ranges from 9% –24.99%, and Credit Limit ranges from $500 - $8,000. APR will vary based on prime rates. Final terms may vary depending on credit review. Monthly Minimum Payments are as low as 3% of the outstanding principal balance plus the accrued interest. Also, you can choose to pay more than the minimum due if you want to pay down the loan faster. Credit line originated by Bright or CBW Bank, Member FDIC. Products and services are subject to state residency and regulatory requirements. Bright Credit is currently not available in all states.

(2)Payment history has the biggest impact on credit score accounting for 40% of how score is calculated per TransUnion(https://www.transunion.com/credit-score). Bright Builder helps you build a payment history that may positively improve your credit score. A credit score increase is not guaranteed. Individual results may vary. Late payments, missed payments, or other defaults on your accounts with us or others will negatively affect your credit score. Products and services are subject to state residency and regulatory requirements. Bright Builder is currently not available in all states.

(3)Applicable when a user chooses annual or semi-annual plans

Latest Version

1.45

June 11, 2024

Bright Money

Finance

Android

976,685

Free

com.brightcapital.app

Report a Problem

User Reviews

Kelly Johnson

4 years ago

ADHDers! Download this!!! I have been searching for a service/app like this for a very long time. I have severe ADHD & have the worst time with personal finances. I just can't seem to get it together. I do ok, don't get me wrong, but it's so overwhelming. Enter Bright Money, my hero. Not only does it automate my payments for me, it helps me save intelligently, it organizes my credit cards & pays them down in the background. I am truly amazed at how much it has done for me thus far. Thanks guys!

Katelyn Frohman

3 years ago

Bright started taking out too much money from my checking account, often leaving it negative. Yet my "stash" didn't seem to reflect that amount. I had to pause auto savings for two months, because the "safety net" doesn't work, and there's no warning of funds being transferred. Customer service is dreadful. I have to repay the $300 dollar loan I "opted for" without any record of how much I've paid on it already. It's unclear what you're signing up for with this app. Only left me more in dept.

Prince Aziz Hunt

2 years ago

Bright Money is a good resource for building credit in a simple way. If you struggle to make payments on time for credit cards, they have a program that will do so for you with money you can't touch. And at the end it's yours to keep (because they saved it for you from your income) and you've got a credit line you can start with them. Just be aware there's a "nominal" fee that's easy to miss and be charged for later on. That blindsided me a bit when it happened, but beyond that it's been good.

Spiral

3 years ago

Bright Money has been a great experience. It's a newer service so I've had to be a bit gracious, but that has not been to my detriment. The service is $9.99/month and offers some great tools such as automatic money withdrawals with an account balance "safety net" (withdrawals can be paused, but not turned off) and an option to pay off cards using either the snowball or avalanche method. They'll notify you if you qualify for their credit line. Customer service is great too. They love feedback.

Lil Monsters Bird Toys

4 years ago

I was able to add most of my accounts, then the app closed and I've been trying unsuccessfully to gain access again for hours. Edit: I contacted Bright as requested and they simply told me to wait 24 hours and try again. I was able to finally get back into my account without their assistance and when I was going through the settings, see that they had proactively signed me up for a $9.99 a month plan that I cannot cancel through the app. Never was divulged during signup.

Liz Crosby

3 years ago

Horrible, they take all your info from your bank and you cards to have you connect for them to tell you that you don't qualify for a balance transfer. You give them access to all your bank info. For accounts they don't need access too, they pull all your credit info EVERYTHING. It's like a financial probing. Go with Tally . They let you know if your approved and you add the cards. This was a horrible experience. I wish I could attach screenshots to this review to help others.

Dave Bomely

3 years ago

I have been using this app for a few years now. It's great if you have alot of credit cards and want to "set it and forget it" to make sure they get paid and don't have to worry about late fees. It's also great at helping you find the best way to pay down you cards and "get out of debt" it has alot of other helpful features as well. My biggest issue as more of a positive criticism that I hope helps it improve over time is that it constantly loses connection with cards and or banks. So Annoying!

Mia Cueto

3 years ago

This app is great to keep track of your credit card bills and some other loans you have financed. As long as you have all the correct account information setup is easy and you can choose how you want to pay these down or as fast as you want to pay down. I was able to keep track of my bills and paid off everything in 6 months without breaking the bank. The only cons is that sometimes your bank or credit account will disconnect and won't update to reflect the true balance, but just reconnect it.

Demilo Dixon

3 years ago

I'm going to use the app because it has all my credit cards in one place so I can see all the due dates, that is a plus. However the Plaid connection is extremely difficult to establish with certain accounts, certain accounts do not come over with all the information and it repeatedly asked you to correct the same information that you just corrected, also reading some of the reviews it really doesn't seem very great at the algorithm to determine how much money you need to actually get by.

Michaele Myers

3 years ago

I have so many issues with this app. All sounds good in theory, but there are so many things that are unknown in its processes that it's hard to follow if or what the app can do for debt, etc. There is also no warning of when the trial ends or how much it costs to participate in the app fully. There is no warning of dates of withdrawal. I set it to manual collection and it auto drew from my bank account today. Can't even delete accounts or goals. Better off budgeting, etc with an Excel sheet.

Ann-Marie E.

3 years ago

I loved this app at first. It helped me pay down several cards and had a savings account going for me. I didn't have to do anything or worry about my credit card payments. It automatically took care of them for me. I'm not sure what happened but it disconnected all my cards and won't let me re-add them. Keeps having errors. I hate it. But I'm probably going to delete it and try to find something else. It was an awesome easy button, but I'm struggling without its help, now. Super disappointed.

Michael Evans

3 years ago

Great app for bringing your finances into focus. If you have multiple cards, relieves the stress of paying on time. (One caution: not all cards are accessible, so pay attention to the ones you have to pay manually). As well, there is a systematic method of achieving financial goals, such as emergency funds, house down payments, etc. Customer support is readily available and quick to resolve issues.

Th3Meddler777

1 year ago

It was great at first, but something has happened in the last month, and the safeguards have stopped working. I have received 12 overdraft fees in the past 3 weeks because the app is over pulling past my limit. Update: I still have not received my money back. It's has been almost a month. The person who reached out on here responded to one email which was no help and was in its customer service, and if they do, they do not care. AVOID THIS APP! Update: 2 months later and still no support.

AJ Archer

1 year ago

Update:05/24 they are still refusing to close the account and still trying to charge! Old: requested this account to be closed 5 months ago and today they have flagged my credit report as 4 payments past due! I don't owe them anything! DO NOT USE THIS APP! Older: do not use this app! I have been trying to close for months and they still are trying to charge me. I had to contact my bank and report them before they "cancelled" my "membership". They still have not closed the account entirely.

Vitality B

1 year ago

Good Job to the marketing team for making this app seem like something it's not, if you have patience and don't have any other way to work on your credit, and are ready to pay 36$-89$ for the membership than maybe you can make this work. As far as advertising of up to 8000$ loan (apply today) don't expect to get far with that! I have a 700+ credit score and wanted to see my options, after paying 89$ looking for the loan application, there isn't one you have to wait 3+ months per support!

Stephanie Segers

1 year ago

[My initial review wasn't favorable, but I'm updating the review to reflect the outcome of contacting them with the issues I had with them.] *Update, Bright issued a refund. It didn't take long for the refund to process. But they also incessantly contacted me afterwards to get an updated review. I'm satisfied with the outcome of this ordeal, so two more stars for satisfactorily resolving the issue. But it's only for resolving the issue. This app needs to make fee schedules MORE transparent.

Mary Collins

1 year ago

Scammers. I would never agree to pay an annual fee for any membership. So randomly, I was changed almost $90 for an annual membership that I did not sign up for. Now on my bank, it's showing no longer pending and it's fully processed. But on this app, I still have to wait 4-5 business days to BEGIN the refund process. Not to mention this whole time, my credit barely moved. But as soon as I got Kikoff or Self I saw a major improvement. Horrible service overall.

Jenna (poplick61)

1 year ago

Before you get this app, you should know this is a $36/month credit builder, not a loan. And they WILL charge even if you don't finish setup. There may possibly be options for loans, but the fee is for the credit builder, and even if you don't finish setting up your account, if you give your bank info, you WILL be charged. I cant speak to the quality of the credit building aspect, as I immediately requested a refund. They do make the refund process a lot easier than I initially expected though.

Fadol Mohamed

1 year ago

It's one of the worst designed apps in the store. The technical issues are not tolerable. Automatically tries to reconnect old credit card accounts that are closed and does not allow you to exit the reconnecting process and navigate the rest of the app. If you successfully do and go to settings, it does not allow you to remove these accounts. And if you try to contact technical support, they reply late and only instruct you to repeat the same process that doesn't work.

*

1 year ago

Bright credit is a scam, don't do it. It's just a way for them to jump on the bandwagon and suck money from you. And the interest seems to go up fast. Don't do it! I regret it! And they keep hounding you for manual payments which defeats the purpose of automation. Update: The app is always inaccurate. Some important info doesn't show at all. Bright balances are mitch match, it takes a very long time for bright payments to be applied. I can't make payments on bright credit.