Grow Credit

June 22, 2024More About Grow Credit

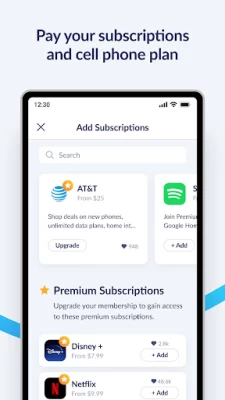

Grow your credit with your subscriptions in three easy steps:

- Apply for your Grow MasterCard.

- Link your bank account.

- Add your subscriptions: Netflix, Hulu, Spotify, or over 100 others.

Your subscriptions will be billed to your Grow MasterCard, and we’ll automatically debit your bank account every month and report your progress to all three credit bureaus.

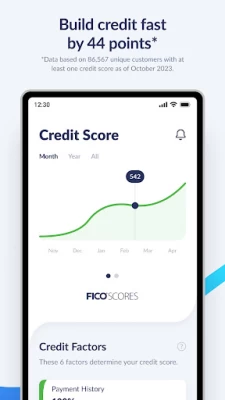

A better credit score means lower interest rates on future loans, which could save you tens or even hundreds of thousands of dollars.

Applying for Grow will not result in a hard credit pull and will not affect your credit score.

The press raves about Grow:

Techcrunch.com: Grow "is a pretty elegant way to solve a problem that’s a real barrier to entry for a large number of financial services. Credit scores can impact mortgages, the ability to receive small business loans, and a host of other services that are ways to boost economic opportunity."

Creditcards.com: Grow is "a very useful tool for climbing the ladder and eventually qualifying for a better card."

Nerdwallet.com: "The Grow Credit Mastercard is ideal for those with no credit or poor credit."

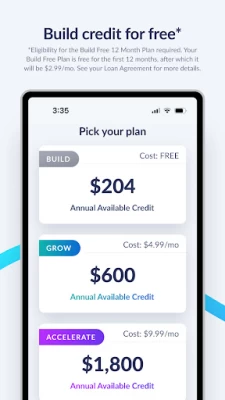

Grow offers 4 plans:

* Build Free

- Reports a $204 credit line to Equifax, Experian, and TransUnion

- $17 monthly spending limit

- Option to upgrade to a Grow membership after 6 months of consecutive on-time payments

- Cost: Free

* Build Secured

- Reports a $204 credit line to Equifax, Experian, and TransUnion

- $17 monthly spending limit

- Option to upgrade to a Grow membership after 6 months of consecutive on-time payments

- $17 security deposit required - refundable after 12 consecutive on-time payments

- Cost: $2.99 per month

* Grow

- Reports a $600 credit line to Equifax, Experian, and TransUnion

- $50 monthly spending limit

- Access to premium subscriptions, including your cell phone bill (AT&T, T-Mobile, Verizon, or Sprint)

- Cost: $4.99 per month

* Accelerate

- Reports an $1,800 credit line to Equifax, Experian, and TransUnion

- $150 monthly spending limit

- Access to premium subscriptions, including your cell phone bill (AT&T, T-Mobile, Verizon, or Sprint)

- Cost: $12.99 per month

Additional Features:

- Plan duration: 12 months - renewable.

- Free FICO Score

- Free credit education blogs and tutorials.

We look forward to assisting you in your credit-building journey!

Security:

• Your data is protected with 256-bit encryption bank-level security and is never stored on your devices.

This app is operated by Grow Credit, Inc. Questions or suggestions can be directed to behappy@growcredit.com.

Latest Version

6.9.0

June 22, 2024

Grow Credit Inc.

Finance

Android

141,776

Free

com.growcredit.prod

Report a Problem

User Reviews

Lars Murdoch Kalsta

1 year ago

$0 fee and no hard pull for a new trade line reporting payment history to all three bureaus is pretty hard to complain about. With the free plan you need to have a job and link your bank account, and your credit line is only $17/month, but put a subscription you had anyway on it and you'll bulk up your payment history, maybe credit mix too. It's good if you're just starting to build credit, not as useful if you've got a lot of history already.

Edward C

1 year ago

1 year update: horrible product that tries to guilt you constantly to keep your subscription Disappointed that it locked me into steps while signing up; I could not modify payment amount or apply referral code, also vague wording about the free plan. Not disclosed that it is on a qualifying basis. I just wanted to be clear about these gripes since they are deliberate design choices, like not allowing users to go back to the previous page after selection. It is disappointing hostile web design.

jason lynn

3 years ago

I would not even give this a 1 star. Signed up and got my account linked. Got my subscriptions switched over and when payment came due they said the were unable to verify funds. Battled this issue for 1.5 months and still having the same issue. There is no other way to make a payment and now I took a 22 point hit on my credit due to 30 day passed due. Closing this account and recommending staying clear of this. There are better companies out there that ACTUALLY work to build credit.

Chef Carmen

2 years ago

I have to say that my experience so far has been great with grow credit. They have helped my credit score increase and I am paying for subscriptions that I pay for anyways. Paying for them through Grow Credit, my credit score has been building higher. I was able to upgrade my plan, and that took just a matter of a couple of hours. Thx Grow Credit. I would definitely recommend you to others. In fact I have already. :)

Ethan K.

2 years ago

Edit: I have a factory set Samsung S22+, so...? OP: Good idea, bad execution. Constant log-in issues (I have never been able to log into the app) have to use a web browser. As soon as I log in, I have to wait for code.. enter it, then re-log-in. Half of my "subscriptions" disappear every month or are not allowed to be used even though they are approved. Bank disconnection is rampant. This was supposed to help my credit.. not hurt it, I believe it will hurt. Canceling, unenrolling.. I'm out.

Serra Ruthe

2 years ago

This app crashes while you are trying to set up the apps Plaid access. I've uninstalled, reinstalled, rebooted my phone and the app, nothing worked to get this app working. It just loops the part where you set up your credentials and you cannot bypass that set up to go further. This app is completely non-functional.

Joseph Jones

3 years ago

I love that in one app you can have all of your streaming services organized in one place. You even get a discount on them which makes up for their most expensive plan. For that $10 dollars, they give you a virtual credit card to have all your subscriptions charged to, and they take the money from you once a month instead of stressing out about which one is getting cut off next. The best part is this activity is reported to the credit bureaus. You can do phone bills and stuff like Ipsy too!

River

2 years ago

This is an interesting idea and I tried to sign up, however it wasn't going to work for my situation so I didn't finish setting up my account. Up to that point I had no string feelings about it either way. But afterwards, I started getting inundated with aggressive emails asking me to finish completing my account, with no unsubscribe button. When I emailed support they were able to take me off their mailing list, but then I got ANOTHER email asking me to rate the support. Enough with the emails!

jesse goff

2 years ago

I have really enjoyed grow credit, helping me with my subscriptions and everything. However, the one problem I have with them. And the reason for the 3 star rating is that when I am being double build by one of my subscription services, Disney plus to be exact, Grow credit says, oh, you have to contact them to stop the payment. Excuse me, please explain this to me that I'm paying for it through. Grow credit and you tell me. I have to contact the service provider to be discontinued.

Robert Johnson

4 years ago

I've been using Grow Credit for a while now to pay for my Spotify subscription. It's nice that they pay my subscription and I pay it later when I get my check deposited. My concern with Grow Credit is I have not seen any change on my credit since I started. I also checked my credit report and see nothing on it from Grow Credit. I've already made 10 payments using the app and all on time. The app says my score is slowly going up, but according to Experian, Equifax and TransUnion, no change.

bridgette ruffin

2 years ago

This is nothing like how they make it seem. When you want to talk to a live person or have to jump throw hoops and wait for them to call you. They charge you to have the account and then won't upgrade you to a plan that will help drive your credit score up. Update:02/17/33 I see they replied but what he failed to mention is that you have requalify for each level. This includes another credit check and a higher service fee! So even if you make the payments on time it's not guaranteed you will mo

Christopher Webb

4 years ago

So far so good, I signed up, linked my bank, was offered a line of credit. Just linked one subscription for now. And once I make the first month's payment I should see an increase in my credit score. And when I get approved for the higher tier memberships they have(which are free) ill really be making a impact on my credit. This is a great free primary for anyone looking to boost/repair your credit.

Sarah B

2 years ago

I'm not sure why others seem to have so many issues with this app. I think it's great, I pay $5 + the monthly due on subscriptions I already had, and that gets reported to the credit agencies. I like it because I'm getting credit for bills I'd be paying for anyway. I think if you already make monthly payments on any of the services they cover, why not get credit for paying them? I wouldn't suggest getting this and then signing up for a bunch of new bills on things you didn't already have, though

Daniel Dykes

3 years ago

I had horrible credit and it's still not great but with the help of GC and a few other credit apps my credit score has went up over 160 points in a year and would've went up more but the loans that I now have has temporarily slowed it's ascent. Not only that but it's easy to cancel; I recently cut back on some monthly subscriptions and I went from premium subscription to the free subscription and it was too easy to switch. Customer service is really helpful too

Liz Leonard

2 years ago

Be extremely careful using this service. I have been trying to pay down my due balance and have been unsuccessful. I've also been trying to contact someone but ironically that selection doesn't seem to work when I press on it, even though all the ones above do. I'm now receiving delinquency notifications from credit berueas and devastated to say the least. I've had bad credit, credit cards and they never did this.

Gabrielle H

2 years ago

Reviews are subjective. The purpose of opening a Grow Credit account is to raise your credit score. And that it did! Sure, the app is glitchy and doesn't work properly sometimes, but who cares as long as my credit score keeps climbing! I have a $150 limit, but they report that I have $1,800! With auto pay, my balance is paid monthly. Love it! My credit score is up almost 100 points! Way better than experian boost! You have to try this!

Demeco Dabney

4 years ago

This app needs a few changes, but overall I see the potential in it. Changes 1. It needs a better payment option. Although they have auto payment, you can't determine the amount you wish to pay. So if you wanted to pay the entire balance, it's impossible to do. Also, they give an option of "early manual payment" between the 1st and 10th (which i thought was a good idea) but even the "manual payment" isn't "manual" because AGAIN you can't determine the amount

Samtation

2 years ago

Fantastic app to consolidate your subscription to one place and build credit. Yes, a credit card can do this as well. But this reports to credit bureaus faster than my credit card. Definitely, something to try out for yourself Already brought my credit utilization down on my Credit Cards. The fee isn't bad but not something I can complain about. But you have a free option.

Scot Rasor

4 years ago

It's for building credit, that's it. The results take time, the entire credit building / credit repair process takes time. If you think you'll sign up and see an improvement in your score within a few weeks you won't, that's not how any credit builder app works. This should be one of many apps like this you use. Payment history, length of credit history and credit mix together make up 60% of your score. Apps like this, 4-6 total IMO, are part of fixing your score.

Killing Floor Skip

1 year ago

Don't sign up for this if your credit is already good. This app cost me -29 points . It wasn't clear that a credit line would be added to my credit report. "no credit check" was very misleading. As if they would not affect your credit. Went from 719 to 690. The additional line of credit was definitely not expected and I would not have signed up if it was clearly made known. I had just opened a 6th account with AMEX. I had 0 intent to add any lines of credit for some years. Remove from my report