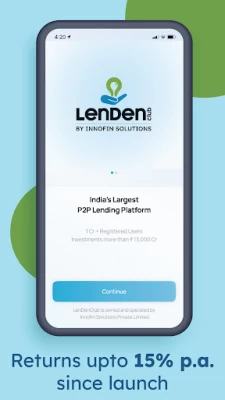

LenDenClub: P2P Lending App

June 20, 2024More About LenDenClub: P2P Lending App

LenDenClub is India’s largest Peer-to-Peer (P2P) Lending platform which provides diverse lending options like Lumpsum & Monthly Income Plan. It is owned by Innofin Solutions Pvt. Ltd. and is an RBI-registered P2P-NBFC successfully operating a safe and trusted financial platform since 2015. FMPP lenders have earned up to 15% p.a. since its launch.

Why LenDenClub?

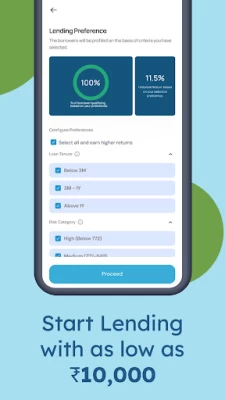

* Lending amount starting as low as INR 10,000.

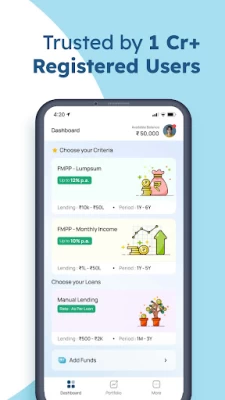

* Trusted by 1 Cr+ users.

* INR 13,000 Cr+ amount lent on the platform since inception.

* RBI-registered NBFC-P2P.

* Secure fund handling through ICICI Trusteeship Services.

* Best Lending Plans (Lumpsum, Monthly Income Plan & Manual Lending)

FMPP performance (Annualized Returns) in October 2023:

Max: 10.15%

Average: 10.11%

Min: 10.05%

How does FMPP work?

FMPP invests your money via proprietary AI algorithms into creditworthy borrowers seeking loans. All borrowers on the LenDenClub platform undergo rigorous KYC and credit assessment checks on more than 600 parameters. Also their robust repayment mechanism is supported by a dedicated collections team.

Credit risk is further mitigated by AI-powered hyper diversification of the amount lent (as low as ₹1). These factors combined together sets it apart from the other investment options and makes it the best lending plan for Lumpsum, Monthly Income & Manual Lending in India.

Key features of FMPP:

* Start lending with as low as INR 10,000

* Zero account opening fee

* No withdrawal charges

* Industry-best referral plans (Passive income)

* 100% digital account opening process

* Secure handling of funds via ICICI Trusteeship Services

* Maximum lending amount INR 50,00,000

Lending options to meet you financial goals:

FMPP: Lumpsum - Lend once, earn big.

FMPP: Monthly Income - Earn monthly interest in your bank account.

Manual Lending - Select borrowers as per your preference.

FMPP Lumpsum:

FMPP Lumpsum enables lenders to hyper-diversify their funds to as low as ₹1. It provides flexible lending options starting from 1 year to 6 years.

Minimum & Maximum Lending amount:

* Minimum lending amount- ₹10,000

* Maximum lending amount- ₹50,00,000

FMPP- Monthly Income Plan (MIP):

FMPP- Monthly Income Plan is an innovative product designed to give the investor a Fixed Monthly Income with lending options ranging from 1 year to 5 years.

Minimum & Maximum Lending amount:

* Minimum lending amount- ₹1,00,000

* Maximum lending amount- ₹50,00,000

Manual Lending:

Manual lending is a new way of borrowing & lending whereby a lender can select their own borrowers. A lender can lend on loan tenure starting from 1 month up to 3 years. Principal along with interest would be credited to the lender’s account as soon as the borrower repays.

Minimum & Maximum Lending amount:

* Minimum lending amount- ₹500

* Maximum lending amount- ₹2,000

Documents Required:

- PAN Card

- Aadhaar Card

- Photo

Eligibility Criteria:

- One should be an adult Indian citizen with a valid KYC and Indian bank account to become a lender on the platform.

- An adult NRI with NRO account and Indian PAN is eligible too.

For any queries, kindly contact us at invest@lendenclub.com

Security & Protection of Privacy

LenDenClub app follows global standards of high-level data encryption/decryption protocols to protect user data.

*Risk Disclaimer: P2P investment is subject to risks. And investment decisions taken by a lender on the basis of this information are at the discretion of the lender, and LenDenClub does not guarantee that the loan amount will be recovered from the borrower.

Latest Version

4.1.5

June 20, 2024

Innofin Solutions Private Limited

Finance

Android

316,086

Free

com.innofinsolutions.lendenclub.lender

Report a Problem

User Reviews

Meet Shah

1 year ago

Overall really nice app. Certainly not a fraud. But there is one improvement which is definitely needed. Can we have premature withdrawal option for FMPP through app?

Masar Shaikh

1 year ago

This is an amazing app,I invested here and got amazing returns. Thank you LenDen Club😊

Bala Murugan

1 year ago

I could not open the application and the all details I am borrowed but the application cannot open in my mobile number

Tarun Saini

1 year ago

Great app. High return. Trustable platform to earn some extra

Sanjana Bhoir

1 year ago

This is an amazing app, I was very scared of investing into P2P platform but I had got my principal along with good returns.Thank you LenDen Club

Sachin Zade

1 year ago

Very user friendly app. You can track portfolio, current investment options, various reports regarding investment, taxation erc.

Eugine Joseph

1 year ago

Great investment platform and has great support with positive and informative staff.

Raymond Joseph

1 year ago

Investing in Lenden Club has been a good experience. The returns are very good. It has helped me meet my investment goals and strategy.

Ekta Yadav

1 year ago

This is an amazing app,very easy portfolio tracking. VERY SAFE AND SECURED PLATFORM to lend your money

vipin ks

1 year ago

Lost almost 1.5k out of my 2k investment 3/5 Borrower didn't paid and they only fone is call then to pay that amount, very irresponsible.

Vikram Rawat

1 year ago

If you want to see your Money grow risk free so this is the platform for you. Very good app and the customer support is also very good.

madhavan B

1 year ago

Account creation and other experience is good. But there is one bug, unable to see the lending history of Lumpsum loans. It says successfully fetched details but nothing shown up. Please fix this issue. Update - Issue has been fixed. I can see details now. Thanks 👍. Increasing the star

Gulshan Saini

1 year ago

Very good platform for investing, don't invest in manual lending, it's risky because the borrower can default loans. but otherwise 10-12% is really good.

Satyam Rai

1 year ago

Received OTP just even when I did not use or know the app as a matter of fact. Kindly acknowledge and revert on priority as any transaction would not be my responsible.

Arbaz Bepari

1 year ago

Hey guys don't install harmful application your data collected and ask you money every time different different numbers and without give any loan and always asked 199 rupees after that install app blackmailing with you... Pls don't use this application this is application report to play store department

Yash Goyal

1 year ago

The app is much better then what peers offer in p2p space. However, there is still a huge scope for improvement to help clients visualize their earning help them in written filing calculate XIRR. Especially on the manual lending side.

DEBASHISH Roy

1 year ago

The LendenClub is one of the best online P2P lending platforms that I have used so far. They are able to provide quick and easy investment options. Great customer support with positive and informative staff. Anyone can trust and explore alternative investment option. Return on investment are consistent on this P2P lending platform.

LovekumaR Badri

1 year ago

Lendenclub has transformed my investment strategy! The platform is user friendly. And the returns are impressive.hinghly recommended for anyone looking to diversify their portfolio.!!!

Aman Pasi

1 year ago

Lendenclub has been a game-changer for my investment.the platform is easy to navigate, and the support team is always ready to help. Consistent and impressive returns.

Abikananda Prusty

1 year ago

It is a great P2P investment platform which you can use to grow your money. I have 2 concern about app which they can improve. 1. Notification tab not showing the notifications 2. Wallet where credit/debit are showing is not useful much. It needs some improvement