OneMain Financial

September 05, 2024More About OneMain Financial

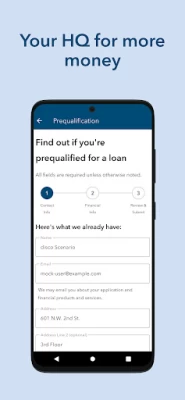

Our personal loans have minimum and maximum repayment periods of 24 months and 60 months, respectively. The maximum Annual Percentage Rate (APR) for a personal loan is 35.99%. Minimum loan amount offered is $1,500 and maximum is $20,000.

Not all applicants qualify for larger loans or most favorable loan terms. Larger loans require a first lien on a motor vehicle no more than 10 years old, meets our value requirements, titled in your name with valid insurance. Approval and actual loan terms depend on your state of residence and ability to meet our credit standards, including a responsible credit history, sufficient income after monthly expenses, and availability of collateral. APRs are generally higher on loans not secured by a vehicle. Highly qualified applicants may be offered higher loan amounts and/or lower APRs. Loan proceeds can’t be used for post-secondary education expenses, business or commercial purposes, buying crypto or other speculative investments, gambling or illegal purposes. Active-duty military, their spouse or dependents covered by the Military Lending Act may not pledge a vehicle as collateral.

Borrowers in these states are subject to these minimum loan sizes: Alabama: $2,100; California: $3,000; Georgia: $3,100; North Dakota: $2,000; Ohio: $2,000; Virginia: $2,600.

Borrowers in these states are subject to these maximum loan sizes: North Carolina: $11,000 for unsecured loans to all customers. $11,000 for secured loans to present customers; Maine: $7,000; Mississippi: $12,000; West Virginia: $13,500. Loans to purchase a motor vehicle or powersports equipment from select dealerships in NC, ME, and MS are not subject to these maximum loan sizes.

We charge loan origination fees. Depending on the state where you open the loan, there may be no origination fee or it may be a flat amount or percentage of the loan amount. Flat fees vary by state, ranging from $25 to $500. Percentage-based fees vary by state ranging from 1% to 10% of the loan subject to certain state amount limits.

Representative loan cost example: A principal amount of $6,000 at an APR of 24.99% over 60 months results in a monthly payment of $176.07. The principal and APR include any financed origination fees. The total amount paid for this loan, including principal, interest, and financed fees, would be $10,564.20. Example based on customer with average credit. Actual loan terms depend on your credit profile, including credit history, income, debts, and for secured loans, ability to provide collateral.

When refinancing or consolidating existing debt, total finance charges over the life of the new loan may be more than current debt because the interest rate may be higher and/or loan term may be longer. Loans include origination fees, which may reduce the amount of money available to pay off other debts.

State Licenses: OneMain Financial Group, LLC (NMLS# 1339418)- CA: Loans made or arranged pursuant to Department of Financial Protection and Innovation California Finance Lenders License. PA: Licensed by Pennsylvania Department of Banking and Securities. VA: Licensed by Virginia State Corporation Commission – License Number CFI-156. OneMain Mortgage Services, Inc. (NMLS# 931153). NY: Registered New York Mortgage Loan Servicer. See more licensing information at nmlsconsumeraccess.org and onemainfinancial.com/legal/disclosures.

Need help with a screen reader? Call 800-290-7002.

Latest Version

9.13.0

September 05, 2024

OneMain Financial

Finance

Android

1,159,307

Free

com.springleaf.mobile

Report a Problem

User Reviews

Dee Martin

3 years ago

This app is truly secure. I lost my phone and could not get into my account. I tried a couple of times and immediately the security disabled me, but allowed me to call a help number as well as gave me an option to retry within 15 minutes. It also notified me via my email about the activity. Great job Team! This kind of security makes me feel safe.

shawn mather

2 years ago

Avoid One main financial, a loan from them is a huge mistake. They will not let you pay extra toward the loan, only take it off the next payment. The only way to pay it off early is to pay off their original calculated amount, including all finance charges regardless of extra payments. And then you're expected to trust them to give you a refund on overpayment. It's a scam loan!

Jullian Niehaus

1 year ago

The app has forgotten my biometric toggle (even though it's still visibly on) so many times that I've just memorized my ridiculously complex password. My security posture is worse because this feature is not fully functional. No issues with the brightway card app, also thru OneMain. Pixel 7 on newest OS with all updates.

Kenneth Jones

2 years ago

One main is not interested in letting you out of your loan or honoring their commitments. I took out gap insurance, unemployment,etc., so when Covid hit, my employer laid us off for 90+ days. A rep emailed a form for me to fill out and fax the form to them to make the payments until I returned to work. They claimed they didn't get it, although it was sent 2x, so it shows 2 months late on my credit. There have been other issues as well, but I'm out of space. Don't use ONE MAIN!!!! Not a good co.

Leslie Chaffin

4 years ago

Since the app update a few months ago I have to verify my device with a 6 digit code EVERY time I log in. It states we do recognize this device. This is the same device I have had for nearly 2 years and none of my other apps have a problem with it, nor the old OMF app. Can this be fixed so that I do not have to recieve a texted code to log in each and every time I go to use the app??? Other than that there are still a few wrinkles to work out on this update, but this is most annoying.

Lisa Nancarvis

2 years ago

Good app however I wish it would allow you to update your direct pay payment method in the app or even online. I have a high disregard for being on the phone due to trauma and being able to update exactly what I need to without having to pick up the phone is quite a lifesaver because I don't need or want the panic attacks or flashbacks. Any other bank allows you to update payment methods but this financial institution makes you jump through this hoop and it's not really beneficial.

Justice4 Patrick

3 years ago

Excruciating horrible customer service. This company is a joke. "We see more than your credit score" false advertising. I have used them for two loans and now all of a sudden they can't do a third loan because my paycheck has to many deductions. What a joke. I have probably used them a good 4 or 5 years to be told there's nothing they can do. They have always gotten their payments and never a problem. Even now my paychecks have the same deductions and I've been paying a higher rate with.

Robert

2 years ago

This is the first time I have been able to use the app to make a payment. Usually it either crashes completely or says something went wrong and to call. I work 12 hour shifts 4-5 days a week. When I get out of work they are closed. I can't call during work hours. I hardly have time to use the bathroom. Hopefully it continues to work. But so far it is a POS. UPDATE...The ACH bounced.i called my bank and they said it never hit. I again have tried several times since to no avail. Update, again

A Google user

6 years ago

this app is very limited on what you can see and do. it allows you to change your payment method (or so it says) but when the time comes for the money to come out of your account it charges your old account still. the app shows the new payment method when you pull it up. ive called into the branch to figure it out and their computers show no new payment methods. im assuming the app and the computers that are actually used in branch are not properly synced up ir something.

Chassidy Epperson

3 years ago

Very rarely does it give me the option to pay with my debit card. When I try to make a payment with my actual bank account it tells me that it's not a valid account. So I have to call and give them my debit card infor EVERYTIME because even though they save my card to my account they dont. It's bad when you have to fight to make a payment, can't wait to get my loan paid off and be done with it.

Dedra Kelly

5 years ago

The app is absolutely perfect!! Shows me everything I've paid, how much of my payment went to principal and how much has gone to interest. This company saved me from being in a crunch. Interest rates are sky high if you have bad credit. The upside to having an account is your credit score will benefit from it. Virginia Beach office is the best!!!!

Asif

4 years ago

I have never had issues with the app. It makes it easy to make and schedule payments. One thing I want to see is the interest rate shown. It is not even mentioned in the statements which I find strange. The interest amount towards the loan is mentioned so why not list the percentage being charged? I dont want to call OMF to find this information when I need to know or refresh memory.

A Google user

5 years ago

One main was quickly and easily able to get a personal loan done for me when no one else would give me a loan due to my credit score. Yes the interest rates and apr are a little higher but the process was easy and there were no prepayment penalties. Fast and quick service. I would recommend if you're in a pinch and trying to consolidate debt.

A Google user

6 years ago

Love the company. Super easy to work with while rebuilding my credit. The app currently won't allow me to log in using my email or user id picked out during my application. I keep getting error messages that the information is incorrect and the team is working on it. I am willing to change the rating once the bug is fixed.

Christopher Buckman

2 years ago

The One Main app is convenient to use. I appreciate being able to see where I am in my repayment process. The site is pretty user friendly and helps me accomplish what I need to easily with little trouble. The only thing I would change is the coloring and font on some of the options (mainly making "buttons" and "bold" font) to make things faster to find and accomplish. Overall good site and I recommend downloading.

David Dichard

4 years ago

The app is basically broken, and it only gets worse every time they "update" it. Doesn't recognize your device no matter how many times you've logged in from it, forcing you to always use a verification code, which works maybe half the time. All of this occurs only if the app actually let's you log in, lately it's been crashing right after I put my credentials in. The app has been as annoying as their weekly calls trying to get me to buy more stuff, even after pleading with them to stop calling

Derrick Nelson

2 years ago

Quick and easy to get a loan. Staff are friendly, though they upsell like crazy. Only thing that annoys me about this place over other places is that they don't give you your actual loan amount you owe. The app gives you the total loan amount with calculated interest if you just make your monthly payments. If you want the actual amount you owe without added interest, you have to call in which is a pain. From my experience, no other loan company does this...

A Google user

6 years ago

Would have given no stars if i could. Very basic app as of 8/6/19. The previous app was very interactive. On 8/1 I was unable to access it. The same today. I uninstalled & reinstalled the app because I saw a recent review with similar issue, and now the app is completely different. it has very limited information, no longer able to complete online challenges, etc.... disappointing.

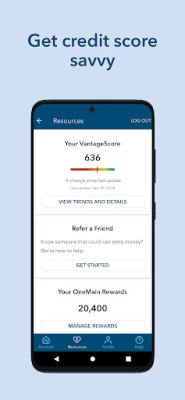

Northern Star Homestead

4 years ago

Very disappointed Vantage score has not updated over a year. Causing my interests rates to be higher than my principle payments. I have a good credit score now of 700. I am on time every month with this bill and all others for years now, never late or missing. Very unfair to us. Seems many have these issues. App is basic. Do not like having to call if I desire to pay more in principle. I will not be seeking future personal loans through OneMain. But, glad I'm close to paying this debt off.

A Google user

6 years ago

App is ok, but doesn't give all the features of the website. I rate it as 1 star because I would NEVER recommend this place for a loan! Not even to my worse enemy! 😠 They are the biggest rip offs there is! You can make a $200. payment & not even half goes to the balance!!! Made a $60. payment & only a few cents was credited to my account!!! If I didn't need a car as bad as I did at the time I wouldn't of took the loan! They take advantage of people with bad credit!