Starling Bank - Mobile Banking

July 14, 2024More About Starling Bank - Mobile Banking

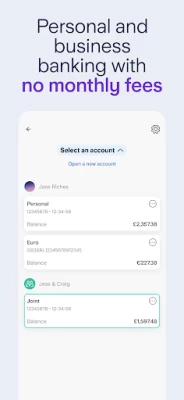

Open a bank account online in minutes - for free - from your phone, and join the millions who have already discovered the better way to bank.

What’s in it for you?

Earn interest on your money with our free current accounts

• Earn 3.25% AER / 3.19% Gross (variable) interest on balances up to £5,000 for personal and joint accounts.

• Interest is calculated daily and paid monthly.

AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year. Gross is the contractual rate of interest payable before the deduction of income tax at the rate specified by law.

No overseas fees

• We won’t charge you a penny for using your card abroad, or for withdrawing cash at an ATM.

• We’ll give you the Mastercard exchange rate, and won’t add anything on top.

• Get notifications in the local currency, and in GBP.

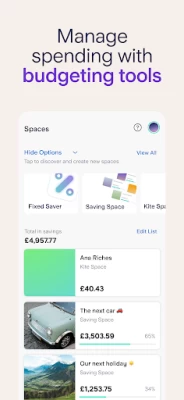

Better budgeting

• Use Spaces to set money aside in a virtual change jar. Personalise with pictures, set a target, and track your progress.

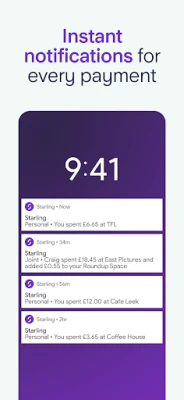

• Get instant payment notifications and track your balance in real-time.

• Learn where your money goes, and how to make savings, with Spending Insights.

• Use Bills Manager to set aside money for your bills. It means your main balance will only show you what’s actually available for day-to-day spending.

• Save on autopilot - automatically round up payments to the nearest pound and put away the spare change.

• Connect to other money management tools through Starling Marketplace, such as PensionBee and Wealthify.

Pay and get paid seamlessly

• Owed money? Send a simple link to get paid back.

• Enjoy easy international transfers to 37 countries from your app – no hidden fees or exchange rate markups.

• Pay people instantly in-app – no fiddly card reader needed.

• Deposit cheques digitally from your phone and pay in cash at the Post Office.

Keep your money safe

• Your money’s covered up to £85,000 by the Financial Services Compensation Scheme.

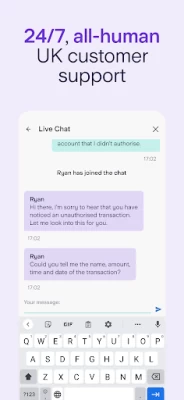

• With 24/7 in-app support from real humans in the UK, we’re always here to help.

• Lock your card in-app and turn settings on and off, such as contactless, online, gambling and swipe payments.

Business banking

No monthly fees. Get mobile and web banking access, 24/7 support and simplified accounting. Deposit cash at the Post Office from as little as £3, and deposit cheques in-app by taking a photo. Automate your expenses, ring-fence money for bills, keep track of invoices with instant payment notifications and spot where your business is spending with smart analytics. Voted Best Business Banking Provider 2023.

The joint bank account

Manage collective household expenses or save up for something big together; our joint account simplifies shared spending. Get instant payment notifications, earn interest, track your spending with Insights, save up together and make important payments from one account.

Banking for the whole family, all in one app

Kite is our free debit card and app for 6-15 year olds. It’s built seamlessly into the adult’s Starling account (personal or joint) for better visibility and control.

Starling Bank is registered in England and Wales as Starling Bank Limited (No. 09092149), 5th Floor, London Fruit and Wool Exchange, 1 Duval Square, London, E1 6PW.

We’re authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 730166.

Latest Version

3.56.1.100705

July 14, 2024

Starling Bank

Finance

Android

3,594,586

Free

com.starlingbank.android

Report a Problem

User Reviews

Benny Anto

1 year ago

Waww, what a service (Business Banking) and all for free. Only 1 positive suggestion: Can 2 small markers or 2 red flags (with N for notes & P for photos of bills) show only on the transactions where the photos of bills are not uploaded & same for notes not added? To Save Time. Compared to my current High street bank, which doesn't even have half of the great easy features Starting has & they charge for everything + close all the branches. Just keeping it to not wreck my credit score.

Eddie

1 year ago

EDIT: I'm happily switched to Monzo after seeing reply from them. App refused to open for non-root device I'm using LineageOS without rooting. Starling App worked fine before, however recently stopped working saying the device not passing security checks. There is no other way to access my account, not even a web interface (without phone).

andrew Butterworth

1 year ago

Really very good app, lots of great features so I'm happy. One tiny improvement would be nice - when you swipe up to see your spending, it would be nice to see you balance after each payment or at least after each day. Currently only shows what you spent each day, which makes keeping track of your spending across the month a little harder. Really good banking experience so far however, feels modern and great for things like kids money via spaces etc. too.

Jiehan Chong

1 year ago

A fast and responsive app in which everything works. This should be the standard banking app experience, but in fact most of the major banks have failed to deliver this until very recently, whereas Starling has been doing this for years.

Universa

1 year ago

Generally decent and simplistically user friendly; more customization and less complexity is always pleasantry. Instant results ; everytime. round up feature is excellent. If there was an A.I system that could make saving up even easier that would be amazing... as round up; only goes so far. More virtual card cover options perhaps and maybe more starling bank card color customizations even if small?

Dan Russell

1 year ago

Great bank, Great app: SUGGESTION how about hold down on the payment/income to add the SUM of the highlighted items. This would be infinitely helpful for myself any many others plus keeps you on top of your spending without having to manually input/delete/keep track of numbers on your own calculator/spreadsheet. Every bank needs this update, but you should be first. Make it happen! :)

Hannah Freeman

1 year ago

Easy to use app, the spaces are really handy as a mini savings space, customisable. Card is really easy to use. Verification seems secure. Customer service is easy to use. Improvements: Have the option to see net spend of categories per month like we used to. Nice to use savings spaces to pay any payments; at the moment it's just for recurring payments, there should be a function like "make payments to this account (e.g Uber eats/Spotify) for all future transactions like you can with categories.

Phill Gillespie

1 year ago

Good bank, pretty good app, but with caveats. Missing obvious things that any normal customer would want, eg scheduled payments by date, and the UI design ignores modern sized phone, eg unreachable all payees button, while new payee is very reachable. Not sure if it's still being actively improved anymore (might be in bug fixes only now).

Neil Spencer

1 year ago

I have been using Starling for a year and a half now, and I have found it to be an excellent banking service. The app is user-friendly and clear, and the customer support team has been quick to respond and helpful whenever I have needed to contact them. The only minor issue I have encountered is that the physical card is of poor quality, with the laminate finish peeling off and the lettering wearing off. Additionally, there is a £5 fee for card replacements.

Andrew Ericson

1 year ago

There's nothing I can't do with the current account. The things I like are every time I make a payment the app lets me know, scheduled payments are notified before they are due. History/ statements are very easy to see, along with monthly breakdowns of spending. It's now over a year since my initial review. I thought I would give an update. Nothing much has changed, other than I appreciate the security, notifications and ease of us abroad. Still 5⭐

Jessica John

1 year ago

Very efficient banking app, the customer service team normally picks up very quickly, the only issue I have is that you can't just change your PIN in the app, you need to call the team or go to an ATM even after verifying your identity. Loads of great features such as the connected spaces, good for when you need to send someone out to buy something on your behalf.

Mei Yang

1 year ago

I was disappointed to find that I could not take a screenshot in the app with my Huawei. The text displayed reads 'Unable to take screenshot of private content'. I am aware that this may be a security function. However I have tested this with my IPhone and I was able to take a screenshot with it. Hopefully this issue can be resolved in the future.

Brian Crook

1 year ago

Love this app, it gets better with every update, a whole bunch of features that make this app brilliant and easy to use. Virtual cards are very useful. Just one niggle from me, I would like to be able to transfer directly from a space to another space without having to move into main bank balance first, any chance???

Owen Donnelly

1 year ago

The app is quick to download and easy to use. I was up and running within minutes. Payments both in and out show up almost immediately. There are many functions for savings and additional accounts I have not yet explored. Great experience so far. Do not think I will be disappointed in the future. UPDATE: after using the for 7 months I have absolutely no complaints. I have set up a separate saving space which is simple to use and responds almost instantly to payments and transfers. Love it.

matty nipples

1 year ago

absolutely brilliant, way ahead of other banks in terms of features, starling add them then years later the others follow. Customer service is excellent, of the few times I've needed to contact them my issues/questions have all been resolved in a timely manner. A few features missing, which I've requested hopefully will get added at some point. Even with other banks trying to entice you away with cash incentives I would not switch back

Suraj

1 year ago

Heavily relies on the app. There is no way to access the account if you don't have a your phone or the app doesn't work. Does not work on a computer without the app. Edit: The cc told me that app is not running because my phone is running a cfw and there is no workaround except installing it on a different device, so I have decided to stop using starling and I will switch to some different bank account soon. Hope you give more flexibility to the users in future versions.

Emily Duffy

1 year ago

The process of creating an account was really quick considering it's all online. It's very easy to use the app and the saves are a really helpful feature for organising and budgeting. Payments come through on time and transfers go through almost instantly and it tells you where every penny you spend goes so you know there's nothing being taken from your account. Would definitely recommend.

A Google user

6 years ago

Moving to this bank was the best decision of my life! I've always had 100% positive experiences and the customer service (where you talk to a real human) is always very efficient, polite and helpful. I travel frequently and have never had any problems withdrawing from ATMs with an incredible exchange rate. The app is easy to navigate and beautifully designed. Can't fault this bank at all. 100/10!!!

K H

5 years ago

Ticks all the boxes for personal accounts (I don't think I need to list them). Not so great for business account though - Bounce Back Loans supposedly are being offered but almost nobody's received one. There's a web form to fill out but nobody reaches out, or if they do, you have to wait forever for approval. They've finally accepted they do need a web app but even with the web app you have to open your phone and enter your password for each payment individually so it takes ages to do a pay run. Worst - for every payment you send, you have to select a category. WHY? Any business bigger than a sole trader uses a proper accounting package. You should be able to turn this off. It's free.. so you can't complain too much but if they want to start charging, they'll need to fix this stuff.

Brian Gomes Bascoy

1 year ago

I really like some of the features this bank provides, like virtual cards ♥️, but I am not a fan of the way the UI is organized: there is a total of 5 views (payments, spending, home, cards, spaces) that you need to navigate to perform common user workflows and it feels a bit awkward/unintuitive to me, for instance, for adding money to a virtual card and see its details you have to go from Home to Spaces, select the saving space, add money, then go to Cards, select the card, and card details 🤷