T-Mobile MONEY: Better Banking

May 29, 2024More About T-Mobile MONEY: Better Banking

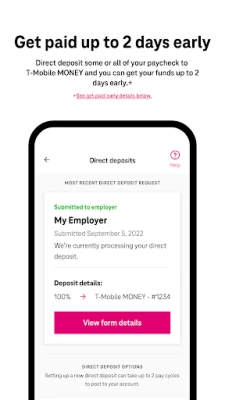

• Set up direct deposit to receive your paycheck up to 2 days sooner⁺

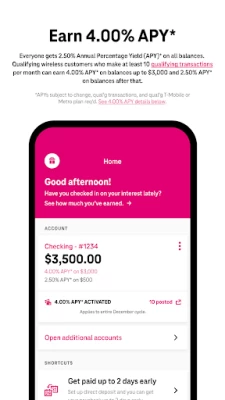

• Earn industry-leading interest on checking and savings balances

• Enjoy exclusive offers on dining, select travel, and more!

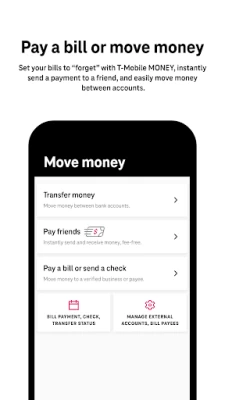

• Send instant payments to other MONEY customers without fees

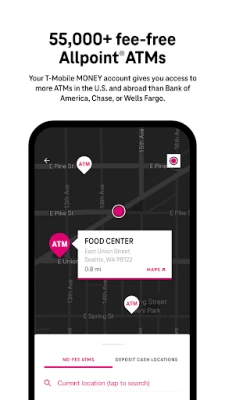

• Withdraw cash at 55k no-fee AllPoint® ATMs^

• Make purchases with a personalized debit card, or enable Google Pay or Samsung Pay for mobile payments

• Deposit checks on your phone or add cash at select merchants (third-party fees may apply)

• Pay bills: pay by check or set up recurring transfers

• Talk to T-Mobile MONEY specialists every day of the year. Y ayuda también disponible en español.

• T-Mobile wireless customers can save $5 per eligible line with AutoPay. Plus, all payments made to T-Mobile count towards perks qualifying transactions.

T-Mobile MONEY is a banking service powered by BMTX. Accounts provided by Customers Bank, Member FDIC. All Rights Reserved.

YOUR MONEY WORKS HARDER

Everyone earns 2.50% Annual Percentage Yield (APY)* on all checking and savings account balances. Plus, qualifying customers who register for perks and make at least 10 qualifying transactions per month can earn 4.00% APY* on checking account balances up to $3,000 and 2.50% APY after that.

SAFE & SECURE

Stay connected to your money with transaction and balance notifications. Easily transfer money to and from external accounts. Temporarily disable your debit card from your phone or browser if lost or stolen.

Prevent unauthorized account access with multi-factor authentication and with biometric login. Deposits are FDIC-insured up to $250,000. Plus, with Zero Liability Protection from Mastercard® you’re protected if fraud occurs.

^The location, availability, and hours of operation of Allpoint® ATMs may vary by merchant and is subject to change.

⁺Subject to description and timing of the employer payroll-based direct deposit.

*How APY works: Checking account customers earn 4.00% annual percentage yield (APY) on balances up to and including $3,000 in your Checking account per month when: 1) you are enrolled in a qualifying T-Mobile or Metro plan; 2) you have registered for perks with your T-Mobile ID; and 3) at least 10 qualifying transactions have posted to your Checking account before the last business day of the month. Qualifying transactions posting on/after the last business day of the month count toward the next month’s qualifying transactions. The first time you fund your account, as an added value, you’ll receive 4.00% APY on balances up to/including $3,000 in the statement cycle in which you make your first deposit of greater than $1, as well as in the cycle that follows that deposit provided all other requirements are met. These added value benefits are subject to change. Balances above $3,000 in the Checking account earn 2.50% APY. The APY for this tier will range from 4.00% to 3.40% depending on the balance in the account (calculation based on a $5,000 average daily balance). Customers who do not qualify for the 4.00% APY will earn 2.50% APY on all Checking account balances for any month(s) in which they don’t meet the requirements listed above. Savings/Shared Savings account customers earn 2.50% APY on all account balances per month. You must have a T-Mobile MONEY Checking account that is in good standing and funded to open any type of Savings account. APYs are accurate as of 12/01/22 but may change at any time at our discretion. Fees may reduce earnings.

For details & more on qualifying transactions, see Terms and Conditions or FAQs.

Latest Version

3.1.1

May 29, 2024

T-Mobile USA

Finance

Android

901,326

Free

com.tmobile.money

Report a Problem

User Reviews

A Google user

5 years ago

Love this to put money aside - WAY better interest than our savings account at our local bank. I've had a couple issues with checks being declined for deposit that have then been accepted in the app for the other bank. That's probably the worst - and that's why it's not 5 stars. I've had to re-login when the app gets updated. A hassle, but not a deal-breaker.

Mama Chan

4 years ago

Interest rate is amazing! Love the ease of use and the high interest. Only thing is they changed it from $200 direct deposit for the 4% to ten debit transactions a month, not including anything but you actually using your card. Not a fan. They should allow the $200 deposit or the ten transactions in order to get the highest interest. Unfortunately only for up to $3000.

Jakob Botteicher

2 years ago

Edit: now getting push notifications like I'm supposed to for transactions. Not sure why it wasnt working before. Nothing changed but now it works! Original: Works great, only issue is, i do not get push notifications at all. I have all my settings set to where i get a push notifications for EVERYTHING, yet i get none.. Otherwise its easy to use, and great.

J Kx

2 years ago

This is a great banking app. If you have a T-Mobile phone, you should definitely use this for your checking account, you will get the best interest rate on your money! The app works great, no issues. Edited to add that when the app doesn't work well, customer service is pretty bad. They listen to the problem, then obviously put in some keywords and read some script about the rules. They just repeat the same script, even if it has nothing to do with the problem. Frustrating!

A Google user

6 years ago

I just opened and account this money May 2019 and so far so good. The features are user friendly and I love the 4% interest that I earn. There is only one feature that does not work yet and it is setting up a transfer from an external bank, ex. If I setup tmobile money account on an external bank the transfer doesn't work. other than that everything else seems to be great.

kalyree spotson

4 years ago

The system can use some improvements, especially with the customer support aspect. The respresentatives are not subject matter experts and they just send you to TMobile support who don't know anything about TMobile Money. However aside from that, it offers a 4% APR on up to 3000$ if you meet the prerequisites and that makes it worth using. Update: The prerequisites were changed without offering a legacy system for the people who utilized the previous method. Will no longer use.

A Google user

6 years ago

This app is easy to use. The mobile deposit is definitely user friendly. I do have one suggestion for the app; on the log in page, maybe at the bottom have a slide bar that once slid, will reveal available balance in account. I have another bank account and their app does this; it's nice if you need to just check balance and may not have time to log into account. Even without that feature, this is a user friendly app.

Jarret Barnes

4 years ago

The opening screen is pointless. If a user doesn't have an account, why would they install the app? Just go straight to the login, maybe have a link on the login page for account setup. Also, remember my credentials. Add a pin or fingerprint login. Maybe ask for the password for moving funds. App is very slow. Bank account is not compatible with Mint or Plaid. If it weren't for the interest rate, I would switch to a different bank. Having to jump through hoops for the best rate is frustrating.

Quinton Reeves

4 years ago

The app itself gets a 4-star rating for simplicity and ease of navigation but the account is where the problem lies. This account doesn't show up on any credit reports nor is it compatible with any of the apps that let you track all of your accounts in 1 place like Dave, Credit Karma or any others. I also can't link this account to my others for the same reason. The 4% is great though. Also the ability to sort/search/filter account activity would make it better as a primary banking app.

A Google user

6 years ago

The bank is fine, haven't had a problem with it. My issue is with the app itself, specifically trying to login. Almost every time I try to login I have to do two step verification by getting a text or email, even with fingerprint login enabled. It's super annoying. Another issue is trying to deposit a money order. I have no problems with checks but money orders for some reason don't work. Fix those things and the rating goes up. The login issue is the most important to me though.

Marc L.

3 years ago

Fix this thing. Every time i click on account activities, it freezes up.😡 Update: After contacting the developers, they worked diligently to fix the problem. Colleen was nice enough to keep in contact until the issue was resolved. Thanks to the developers for their support and efforts. Update 2: when transferring money, it shows money is in but it doesn't reflect on available balance until 2 days later. Back down to 3 stars

A Google user

6 years ago

As a loyal customer, I've enjoyed T-Mobile's progress over the last several years. With T-Money, I was excited to switch over. However, it has been nearly a month now and my account still has not been set up and I cannot access the app due to a connection issue. I called 2 wks ago where I was told my account was set up and deleted for some reason. I called once more and they are still citing the same issue for a large multitude of customers. cant recommend.

Michael Hatch

4 years ago

UPDATED: It has improved. It seems more reliable although some of the old issues are still around. For some reason it seems to require my password and not use fingerprint pretty often. It even refuses to accept your password at the times requiring the password to be reset frequently. I guess it can be a positive but it is annoying to be blocked when you need to be in a hurry.

Christopher Almojuela

4 years ago

Updating my review to reflect the recent change to the requirements to keep the 4% interest rate. Unhappy that they now require 10 purchases to keep the 4% rate. They should have at least kept the $200/month transfer as an option instead of removing it completely. I moved my money out but at least they don't charge a fee for a zero balance. The app has not given me any problems. Works as well as other bank apps.

dscott7811

5 years ago

5 stars for the account itself, 2 stars for the app. This bank account is awesome. I love the interest and have never had an issue transferring money. Some sites don't like the routing number, but I've never had a problem with the card. This app is not so great. It's laggy and buggy. Since the last update, the app freezes when I try and view transactions. It's overly complicated for a banking app and it's the biggest pain using this account.

A Google user

6 years ago

"SUCKS!!!" ...I'm assuming everyone gets the two-step verification process. I get through the first one fine but when I try to enter the second one the app shuts down completely. I've reinstalled the app twice, but to no avail. I virtually never any problems with apps on my phone!!! I have to access the account from my laptop instead

C J

3 years ago

It's been easy to use thus far and has been a great second chance account after being less than responsible with my previous financial institution. Obtaining a checking account that is covered by FDIC was difficult but I've been able to use this to pay off my negative balance with my credit union, pay bills, make transfers and even send personal checks through their bill pay service. You won't find 4% interest anywhere else. I'm just sad I can't open a second checking account with them.

A Google user

6 years ago

Super Laggy and not intuitive. Hard to navigate and just not user friendly. I need to change my security questions and there just no way to do it. Same with password. Even when I sign in on a PC, it is laggy and tricky. I never have a problem with the card, just the apps. The problem is when I need to know what is on the account, it takes a long time.

Sir Spanksalot

1 year ago

I dont understand why it takes almost a week for money I transfer to the card. I have had money in the account waiting for it to transfer and it takes so long that a bill on autopay takes some of it then I get charged a fee because of insufficient funds for a transfer that didn't happen!! I love the higher interest rates but the app really needs alot of work. I have way too many issues trying to connect to bank accounts also. Plaid is garbage! Had the app four years and still can't connect!!

Brittany Knoetgen

1 year ago

I have had my T-Mobile Money bank account for about 6 or 7 years now, and it has never failed me. Even switching phone carriers more than once, there has never been a mistake in transactions, no fees, it has been steady and trustworthy, which is exactly what I want in a bank. I have been able to do bill pays, transfers to other banks, cashapp, everything. The app is easy to use, too, and lots of ATM and deposit locations.