Upgrade

June 13, 2024More About Upgrade

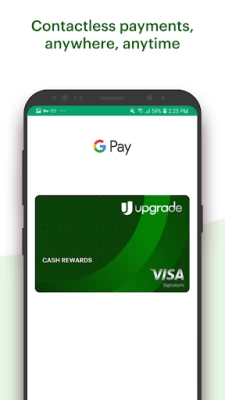

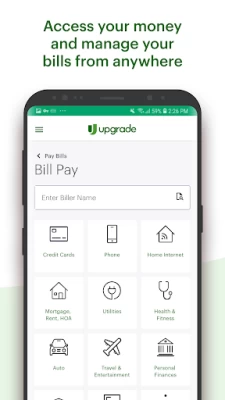

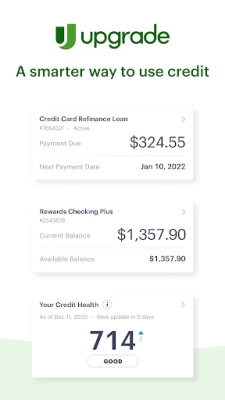

• No Monthly-fee Mobile Banking – Check your balance, pay bills, manage funds.

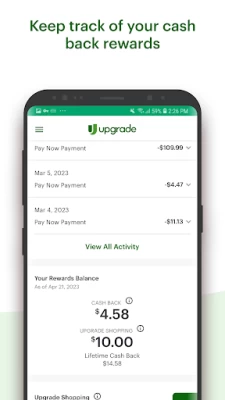

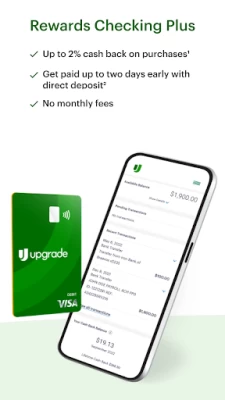

• Track Your Debit Rewards – Track your rewards, up to 2% cash back on purchases (1).

• Manage your Upgrade Card or Loan (3). – Manage your payments and check your outstanding balance.

• Manage your credit score - Check your credit score and get notified of any change in your credit report or track potential ID theft.

Share your feedback at mobile_app_feedback@upgrade.com

1: Rewards Checking Plus customers who set up monthly direct deposits (https://www.upgrade.com/deposits/active-account/) of $1,000 or more earn 2% cash back on common everyday expenses at convenience stores, drugstores, restaurants and bars - including deliveries - and gas stations, as well as recurring payments on utilities and monthly subscriptions including phone, cable, TV and other streaming services, and 1% cash back on all other debit card purchases. 2% cash back is limited to $500 in rewards per calendar year; after $500, customers earn 1% cash back on all eligible debit card purchases for the remainder of the year. Rewards Checking Plus accounts with less than $1,000 in monthly direct deposits 60 days after account opening will earn 1% cash back on common everyday expenses and 0.50% cash back on all other eligible debit card purchases. Some limitations apply. Please refer to the applicable Upgrade VISA® Debit Card Agreement and Disclosures for more information.

2: Early direct deposit requires set up of recurring electronic direct deposit from your employer, payroll, or benefits provider and is limited to direct deposits under $5000. Early access to direct deposit funds depends on the timing in which we receive notice of impending direct deposit, which is generally up to two days before the scheduled deposit date.

3: Personal loans made through Upgrade feature Annual Percentage Rates (APRs) of 8.49%-35.99%. All personal loans have a 1.85% to 9.99% origination fee, which is deducted from the loan proceeds. Lowest rates require Autopay and paying off a portion of existing debt directly. Loans feature repayment terms of 24 to 84 months. For example, if you receive a $10,000 loan with a 36-month term and a 17.59% APR (which includes a 13.94% yearly interest rate and a 5% one-time origination fee), you would receive $9,500 in your account and would have a required monthly payment of $341.48. Over the life of the loan, your payments would total $12,293.46. The APR on your loan may be higher or lower and your loan offers may not have multiple term lengths available. Actual rate depends on credit score, credit usage history, loan term, and other factors. Late payments or subsequent charges and fees may increase the cost of your fixed rate loan. There is no fee or penalty for repaying a loan early.

Personal Loans and Auto Refinance Loans are made by Cross River Bank or Blue Ridge Bank, Members FDIC. Home Improvement Loans are made by Cross River Bank, Member FDIC, Equal Housing Lender.

Personal Credit Lines are made by Cross River Bank, Member FDIC. The Upgrade Card is issued by Cross River Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc

Upgrade, Inc. (NMLS #1548935) holds the following state licenses (https://upgrade.zendesk.com/hc/en-us/articles/4404416360731-Overview-State-Licenses-and-Consumer-Information ) and does business under the following DBAs (https://www.upgrade.com/dba/).

Checking and savings accounts are provided by Cross River Bank, Member FDIC. Upgrade VISA® Debit Cards are issued by Cross River Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc.

Upgrade is a financial technology company, not a bank (https://upgrade.zendesk.com/hc/en-us/articles/115005202407--Is-Upgrade-a-bank-).

Latest Version

1.17.0

June 13, 2024

Upgrade, Inc.

Finance

Android

939,676

Free

com.upgrademobile

Report a Problem

User Reviews

Millie L

3 years ago

Beware, sounded good to get a good amount but turns out it's a loan, not a credit card. Interest is extremely high and they make it a hassle to make advance payment. I'm trying to pay it off faster and sooner than it's intended schedule but they sure trying for the profit they make from interest. After I pay this off, definitely wouldn't use again.

Case

2 years ago

Great app. It's easy to use & I really like the credit report simulator Being able to see how certain actions would affect your score with an actual AMT of pts, even if only estimated, is extremely helpful. I like this app, for that reason, better than the apps that are specifically for credit monitoring. I haven't used it personally but there's also the option to transfer your other other balances to this acct. That's a great option if you're paying higher interest on your other cards.

Brian D (Reaper)

1 year ago

They just dropped my credit limit, making me be maxed out for no apparent reason. I've made every payment on time or early, I've even paid the card off early, and this is the thanks I get. I'll be leaving this company ASAP. I'm going through a hard time but still staying current with this company on payments, so they closed my card and still charge 29.99% interest.

Eric DeWolf

2 years ago

TLDR-App doesn't work. App is broken, doesn't let you "add a bank account" (I already have one saved so I have no idea why this prompt keeps popping up). If I try and explore the app at all it just throws me that "add a bank account" pop up and then cycles back to the menu. I'm using a Redmagic 8 pro so I seriously doubt it's a hardware issue on my side.

Michael Deck

3 years ago

This is one of the WORST finance apps. Downtime at 7pm on a Friday when I'm just trying to see if I have available credit. Occasionally broken app elements, pending payments aren't displayed. If you have an Upgrade Card and you try to set up payments from your Upgrade Checking, there's no easy way to add Upgrade as a bank for payments or via Bill Pay as a biller. Yikes. No easy way to see payment history. Missing many typical banking app features. Also no follow-ups on bad app reviews!!

Sandy Ice

3 years ago

This app is great as long as you only want to see your activity. If you are hoping to be able to pay off your total balance, forget it! The app does NOT calculate in the interest due. And, not only does it NOT do that, you'll wind up paying three times...the balance you assume is the correct total balance, then the interest which is also not correct, then a penny! Yep, the interest is off by 1 penny. This is a fact related to me by a customer service rep after playing this game for two months.

Rain Hall

3 years ago

The app is ok but this company has completely failed! They've reported incorrectly on my credit report. I've paid approximately $900 a month and have never been late or overdrawn. One night, every payment I ever made disappeared and added 8k to my balance. They said it was a "bug" in their system and they'd have it fixed in about a week. It's been almost 2 months and it's hit my credit report. I have a zero balance and they've still not unlocked my card for use. Such bs! Nobody helps me there!!

Sweet_Pea_ 4180

4 years ago

Very poor app, and customer service.. it takes forever to get through to the company on the phone. Lately when I made my payment..I always do it over the phone. And I'm on old for 45 minutes or more! Which is absolutely ridiculous. Who has time for that, just to pay a bill? And I don't trust your automatic payment system. I've already been screwed over a few times doing it that way.and my payment was late. Then they charged me late fees!! Absolutely absurd app/ customer service 😠😠😠

BOO Edmonds

1 year ago

The app is good, but the credit company is horrible. They can and will take away your credit even if you're paying on time and not using the credit. If you're trying to rebuild your credit and you're lowering your balance with them and increasing your credit available, they will take it and only give your new balance as a new credit limit. It's horrible. When they lower your available credit, that drops your score. I can't wait to pay them off. I should have listened to other borrowers.

Jason Wallingford

4 years ago

I applied for a line of credit and a loan. I think I was denied for both but received alternative offers. Both of which stayed on the screen long enough to frustrate and annoy me because they disappeared immediate and I was not able to go back and try either of them. The card might be okay but the app is just trash and almost looks like a low effort scam. Hard to take seriously

m aulet

2 years ago

I would be careful before opening a loan or credit line, the way the do the payment arrangement makes it difficult to pay down the loan or credit line early, almost like they want you to take a long time to pay your balance so they can keep charging you all that interest which is super high. Any attempts to make smaller payments as often as you want to bring the balance down is pretty much impossible... whatever additional payments have to be higher than the monthly payment due, on auto pay

The One & Only JAY

3 years ago

It's amazing! It's a loan (that gives you cashback) credit card! You get a huge amount, gives you different amounts you prefer to withdraw & move to any checking account! It gives you your monthly payment option before conforming to make sure that's what you want! You get the funds the next business day or less. The app is amazing, I got an 8k amount to my SoFi bank to pay off all my credit cards & a other loan. Payments smooth for about 7 months now. Intrest isn't noticeable paid in full.

Everett Herrington

3 years ago

Not a bad company. The app is janky though. For instance, bill is due by a certain date, I pay the bill, in advance. Sometimes weeks. It takes the money, and allows me to put it in the monthly payment box. But it uses the payment as an extra payment, and the monthly bill is still due. I probably won't use them again, unless they fix this flaw.

Jacob Thompson

3 years ago

Decent overall. The huge detractor for the app is the payment system. I like to make weekly payments throughout the month equaling a lot more than the monthly bill. I do so because of my other bills and budget. This app will not allow any payment less than the minimum amount due at a time, and STILL does the automatic deduction of the billed amount, even if you paid the full amount a 2 or 3 days earlier. Upgrade needs to figure out how to allow payments less than the minimum amount like others

Laura Jones

1 year ago

Love the concept, but the app is awful. I just tried twice to make a payment. The first time it stated that there was an issue and I need to email them. The second time it said it was pending. Didn't receive an email. If I get charged twice I'm going to to be so upset. The app is extremely outdated and glitchy... so glitchy.

Christopher Fry

1 year ago

Slight app issues, but otherwise no complaints with the company. The issue I have is that randomly, even if I was already logged into the app, it will force me into a CAPTCHA to get in. I understand the safety measure, but maybe every other day or when it detects something fishy, not 5 minutes later when I simply minimize the app to do something else then come back to it. It's a hassle when I'm trying the actively make a transfer or something...

Christopher Burkett

1 year ago

I have been an Upgrade customer, for only several weeks now. However I am finding their app, a great financial tool in many ways. From current credit, and checking account balances, to credit scores, everything is at your fingertips. The app is easy to navigate, and understand. Appears to be a great company, with excellent customer service, by phone as well. Highly recommended

Michele Campbell

1 year ago

Not impressed. They limit the things you can do on their apps such as making an extra payment you have to call to do that you can't update payment methods, and you can't even change your phone number with them by calling they need you to send pictures of you holding your ID with a request for the change of the phone number. they make sure they report my balance every month to the credit bureaus, but every time I've paid it off and have a zero balance they never update it. Bad for consumers

Ashley Lawson

1 year ago

From 5 stars to 1 star, and only because I can't give 0 stars. Getting and managing a personal loan was easy and straight forward, but Upgrade banking is a nightmare in every way. It makes it more infuriating to call in for help and there are 57 departments and no one knows anything about the other departments or their own! After spending wayyyy too long trying to figure everything out with support, I don't have the patience to call back in. However, I'm eager to close all these accounts asap!

Stanley G

1 year ago

Don't do it. Card seemed good at first in a pinch to pay off some debt. Once you start making payments, they will lower your credit limit time after time. I have auto pay set up and never missed a payment. I try to make little small purchases while I'm paying it off so I don't get hit for no activity. Furthermore it's not really a credit card. "The limit is not reported to credit bureau".... so they say